Descrição do PDF Form 4506 T for IRS: Sign Tax Digital eForm

When you want to get a loan, potential lenders will usually want to know your financial situation. That’s why they may ask you

. By completing this document, you allow your creditor to get the required records. A common situation is when you wish to get a mortgage. With the help of this form, the person or company to whom money is owed can verify your income or even gain your tax information.

This template is also useful when completing a tax return for the Internal Revenue Service.

You may verify

.

The “T” is for a transcript. This means that your sample includes a line-by-line printout of the data from your past tax returns.

Using this document lets you receive tax information from the last three years. But if your goal is to access older information, it’s more advisable to file IRS Form 4506. Note, that filing this sample costs $50 and takes up to 75 days for delivery, while

in no more than 3 weeks.

✓ Include your individual taxpayer identification number or employer identification number and your SSN.

✓ Indicate your current address and list any previous ones.

✓ Specify the purpose of your request: business or personal.

✓ Choose which type of data you are applying for.

✓ Add your spouse’s data for a joint return.

✓ Enter the number of the form for the requested transcript.

✓ Indicate the year or period requested.

✓ Put the current date.

✓ Add your signature and your spouse's one if needed.

You may

or find a tax specialist.

With that said, it’s much easier to use your mobile device.

.

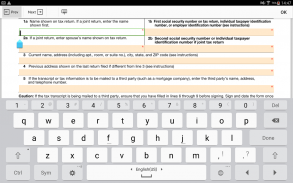

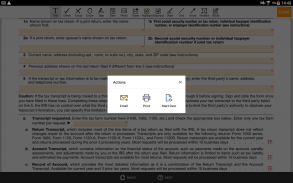

✓ Type and edit text anywhere you want on the form;

✓ Easily navigate between the fillable fields;

✓ Use editing tools from the toolbar on the top of the screen;

✓ Add the date and graphic content including checkmarks, watermarks, graphics or lines;

✓ Create a legally binding digital signature with your fingertip or stylus;

✓ Submit the completed document or instantly print it from your smartphone or tablet.

Note, that you’re able to choose the way you will receive the transcript: by mail or electronically.